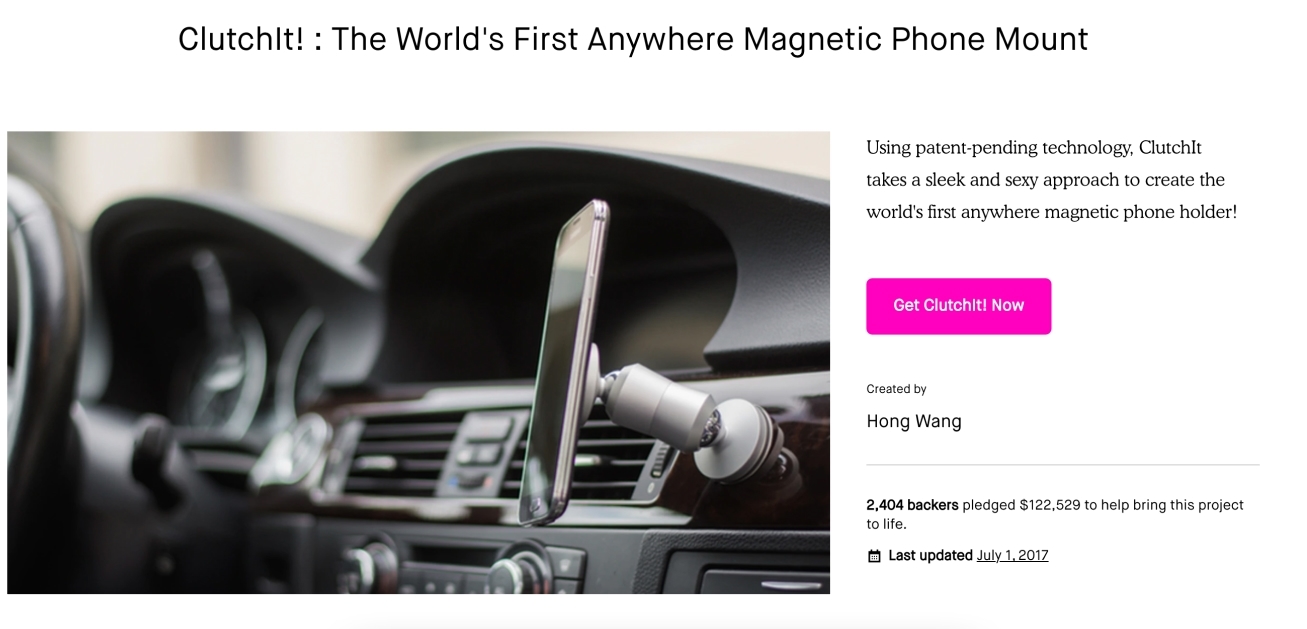

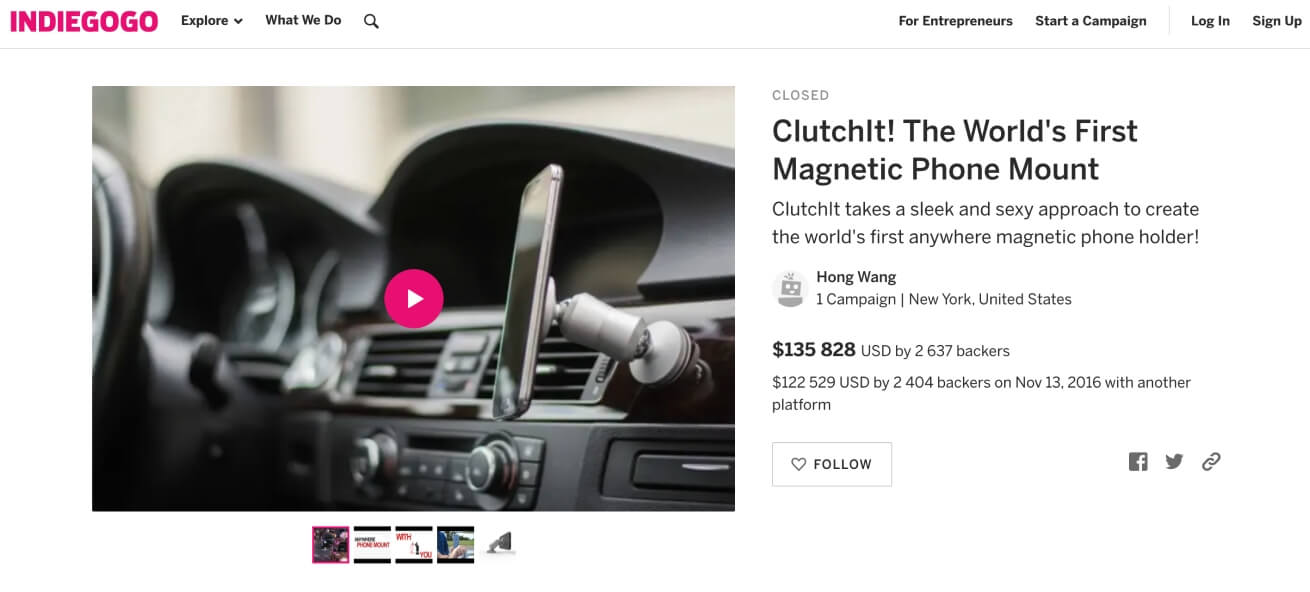

We Helped Raise

$258,357 on and

and

Fundraising through rewards-based crowdfunding or seed funding is a strategy that involves receiving financial contributions from backers in exchange for a product or service to be received at a later date.

Equity crowdfunding differs from reward-based crowdfunding in that it allows a startup or private company to exchange funding for equity or stock or securities to be sold to the inventors or backers. This can involve the sale of stock, convertible notes, debt, revenue shares and so on.

Crowdfunding is the process where a startup funds its new product or service by raising small amounts of money from a large number of people in order to generate seed capital and provide the product or service at a later time.

A business owner, inventor or creator creates a “pitch” by describing their product or service through a video or landing page and asks backers to contribute to the successful launch of the product or service.

The birthplace of crowdfunding originated in Britain by a rock band in 1997. The rock band successfully crowdfunded its reunion through online donations from fans and music lovers. This inspired the birth of the first crowdfunding platform named ArtistShare in 2000 and the rest is history.

This type of financing works well for inventors, start-ups and small businesses looking for an alternative way to find seed capital.

There are a few key ingredients to a successful crowdfunding video.

It needs to be clear and concise. You only have a few seconds to capture the viewer's attention, so make sure your message is clear from the get-go.

It needs to be emotional. crowdfunding is all about using emotion to drive people to take action. Your video should tap into that emotion and inspire people to support your campaign.

It needs to be specific. Generic crowdfunding videos are much less likely to be successful than those that focus on a specific goal or project.

Keep it short, keep it emotional, and keep it focused on your project. With a great video, you can make your crowdfunding campaign a success.

Crowdfunding videos are an essential tool for driving project success. By giving potential backers a clear and concise overview of your project, you can increase the chances of reaching your crowdfunding goals.

In addition, crowdfunding videos can help to create a sense of excitement and urgency around your project, prompting potential backers to take action.

Furthermore, by featuring genuine testimonials from past backers, you can instill confidence in potential backers and show them that you are committed to delivering on your promises.

Ultimately, crowdfunding videos are a powerful way to engage with potential backers and build support for your project.

When it comes to crowdfunding, a video can be worth a thousand words.

That's because crowdfunding videos help to tell your story, connect with potential backers, and explain your project in a way that text simply can't.

In addition, crowdfunding videos can be a great way to build excitement and momentum for your campaign.

After all, people are more likely to back a project that they're excited about. And what's more exciting than watching a crowdfunding video?

So if you're thinking about launching a Kickstarter or Indiegogo campaign, don't forget to include a crowdfunding video. It could be the difference between success and failure.

The answer is: it depends.

A crowdfunding video can certainly help to raise awareness of your campaign and attract potential backers, but it's not absolutely essential.

Ultimately, what will determine the success of your campaign is the quality of your project and how well you market it.

If you have a great project and you're able to generate buzz and excitement around it, then you stand a good chance of reaching your fundraising goal, even without a crowdfunding video.

Of course, if you do decide to create a video for your campaign, be sure to make it good! A poorly made or boring video could do more harm than good.

So if you're going to go the extra mile and create a crowdfunding video, make sure it's something that will really capture people's attention and get them excited about your project.

The cost of producing a high-quality crowdfunding video can vary widely depending on a number of factors, including the length and complexity of the video, the location of the shoot, and the experience of the production team.

However, as a general rule of thumb, you can expect to pay anywhere from $1,000 to $10,000 for a professionally produced crowdfunding video.

Every crowdfunding campaign is different, and therefore each video will need to be tailored to fit the individual campaign. However, there are a few general guidelines that can be followed in order to ensure that your video is effective.

First and foremost, the video should be clear and concise. It should introduce the viewer to the project or product in a way that is interesting and easy to understand.

Additionally, the video should be visually appealing, featuring high-quality footage and graphics.

Finally, the length of the video will depend on its purpose; if the goal is simply to introduce the viewer to the project, a minute or two should suffice. However, if the goal is to provide more detailed information about the project, then the video can be longer.

Ultimately, there is no one-size-fits-all answer to this question; it will depend on the individual crowdfunding campaign.

Crowdfunding videos are an excellent way to raise money for your project, product, or business. By creating a crowdfunding video, you're able to tell your story and explain why you're raising money in a way that's engaging and visually appealing.

Kickstarter videos also help to create a sense of urgency and social proof, as potential backers can see how many people have already pledged their support.

In addition, crowdfunding videos can be shared easily on social media and email, making it easy to reach a wide audience.

So if you're looking for an effective way to raise money, consider creating a crowdfunding video.

Crowdfunding videos are a great way to get people interested in your project or product. Here are a few tips on creating a successful video for your campaign.

Begin with a clear and concise message. Explain what your project is and why people should care about it in less than two minutes.

Ensure your video is visually interesting. People are more likely to watch a video that's visually appealing and easy to follow.

Don't be afraid to be creative. A crowdfunding video is a perfect opportunity to show off your personality and get people excited about your project.

Finally, don't forget to include a call to action. Tell viewers how they can support your project and encourage them to share the video with their friends

When it comes to choosing a video production company, there are a few things you should keep in mind.

First, what is your budget? Second, what is the scope of your project? And third, what is your timeline?

Once you have a clear understanding of your needs, it will be much easier to find a company that can meet them.

If you're on a tight budget, you may want to consider a company that specializes in crowdfunding videos or Kickstarter videos. These companies are typically able to produce high-quality videos at a fraction of the cost of traditional production companies.

Finally, be sure to ask about the company's turnaround time. Depending on the complexity of your project, you may need your video can take a little to a considerably longer period to make.

Making a crowdfunding video is a great way to get people excited about your project, but it can also be a major expense. Your budget for a crowdfunding video will depend on your goals and objectives.

If you're just looking to create a basic crowdfunding video that introduces your project, then you can probably get away with spending around $1,000.

However, if you're hoping to create a high-quality crowdfunding video that really makes an impact, then you'll need to budget accordingly.

For most crowdfunding campaigns, we recommend setting aside at least $3,000-$5,000 for your video production costs.

There are a few different types of crowdfunding videos, each with its own advantages.

Pitch video. This is the most important type of video, as it is your chance to sell potential backers on your project. The pitch video should be around two minutes long, and should give an overview of your project and why it is worth backing. You should also include a call to action at the end of the pitch video, telling viewers how they can support your campaign

Update video. These videos are generally shorter than pitch videos and are designed to keep backers updated on the progress of your project. Update videos should be released on a regular basis throughout your campaign, and can be used to thank backers for their support or to announce stretch goals

Thank-you video. This video is released after your campaign has ended, and is used to thank backers for their support. Thank-you videos can be any length but should include a personal message from you and your team.

Kickstarter videos are similar to crowdfunding videos but are shorter and more focused on showcasing the product or service that you are raising money for. Kickstarter videos should be around one minute long and should give potential backers a clear idea of what your project is all about. Like crowdfunding videos, Kickstarter videos should also include a call to action at the end, telling viewers how they can support your campaign.

Here are three examples of recent successful crowdfunding campaigns and the brands behind them.

Oculus Rift, a virtual reality headset. The campaign raised over $2 million, making it one of the most successful Kickstarter campaigns of all time. The video for the Oculus Rift campaign was very professionally made and did a great job of explaining the product and its potential

Pebble Smartwatch. The Pebble team raised over $10 million, making it the most successful Kickstarter campaign ever. The video for the Pebble campaign was very simple and focused on showing off the product. It was clear that a lot of effort went into making the video, and it paid off.

Flow Hive: Honey on Tap Directly From Your Beehive's use of video was particularly effective in showcasing the product and demonstrating how it works. The campaign reached its fundraising goal of $70,000 in just four days, and it's easy to see how the crowdfunding video helped to make that happen. Thanks to the video, potential backers could see exactly how the Flow Hive works and why it's such a unique and innovative product.

All three of these crowdfunding videos were successful because they were well-made and focused on showing off the products. If you're thinking about making a crowdfunding video, keep these examples in mind and you'll be sure to create a success story of your own.

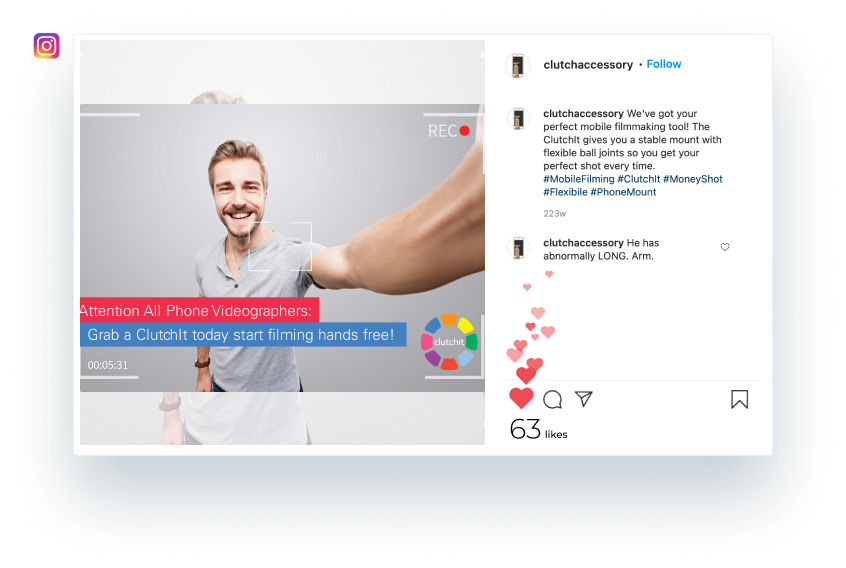

When you're running a crowdfunding campaign, one of the most important things you can do is promote your video. After all, your video is the best way to introduce potential backers to your project and get them excited about it. Fortunately, there are a number of ways to promote your crowdfunding video.

One of the most obvious places to start is with your own personal networks. Make sure to post the video on your social media channels and email it to your friends and family. You should also encourage them to share it with their own networks. You never know who might be interested in backing your project

In addition to promoting your video yourself, you should also reach out to relevant bloggers and influencers and ask them to share it. Ideally, you want to find people who have a large audience but who are also genuinely interested in what you're doing

Finally, don't forget about paid advertising. While it can be tempting to try to save money by relying solely on organic promotion, paid ads can be a great way to reach a larger audience quickly. Crowdfunding platforms like Kickstarter and Indiegogo often offer promotional tools that can help you get your video in front of potential backers.

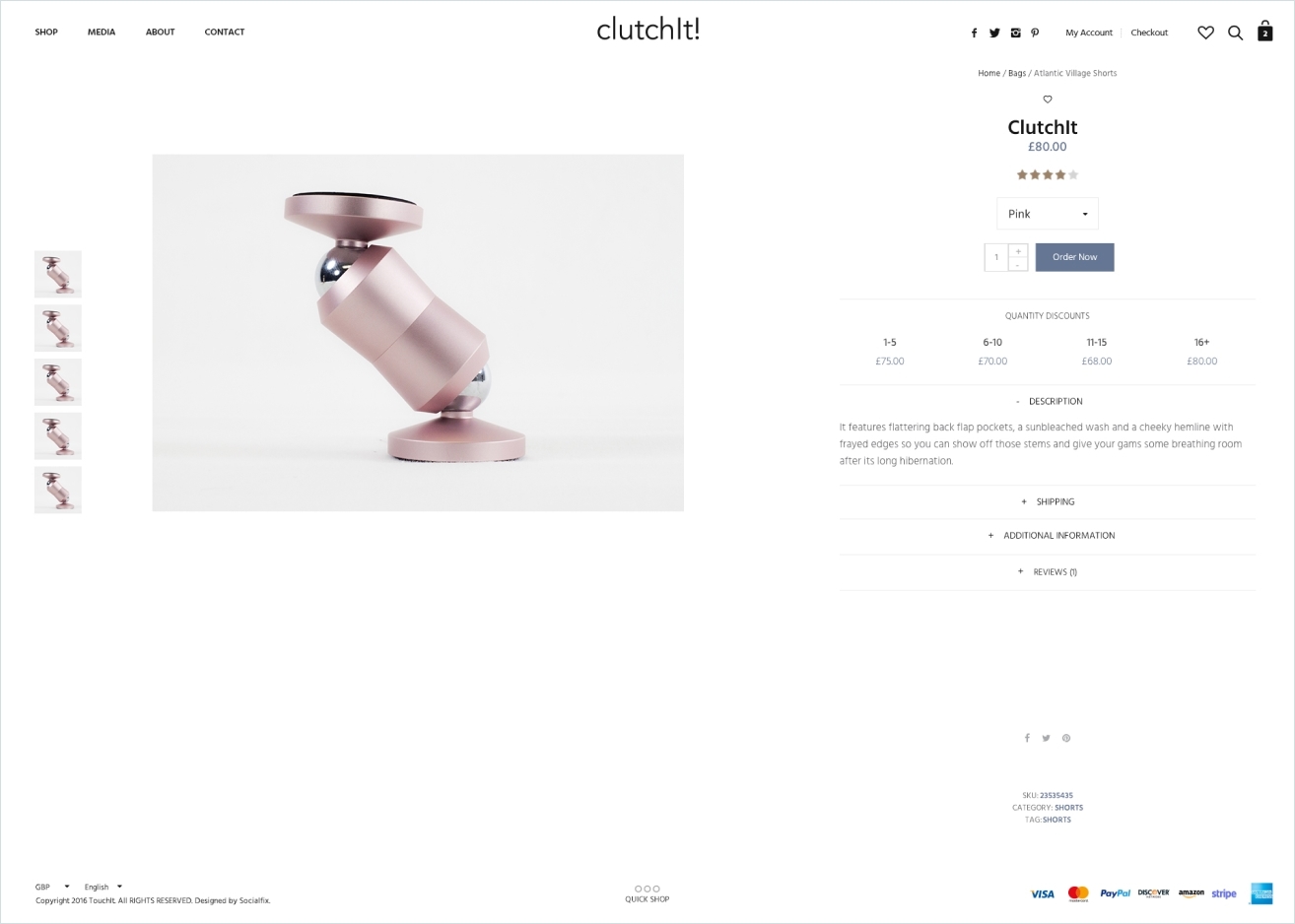

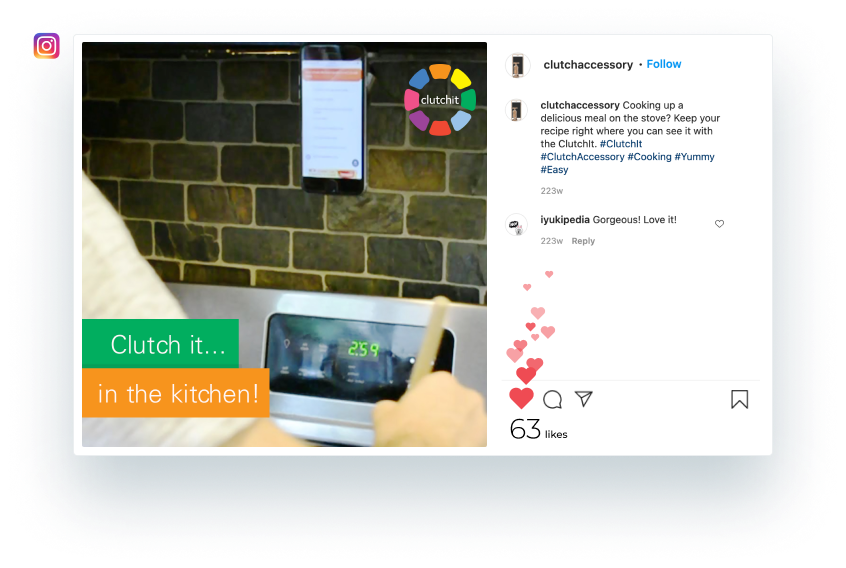

Yes, we can! Check out some of the kickass marketing strategies we’ve developed for clients to help their brand awareness and customer conversion here.

Yes, we can! Check out some of the stellar web pages we’ve developed for clients to help them boost traffic and convert customers here.

Yes, we can! Check out our crowdfunding video capabilities here. If you’re looking for reliable & timely help with your event get in touch with us, today!

There are a variety of crowdfunding platforms to choose from and each platform has its own pros and cons, so it's important to select the one that best suits your needs.

For example, Kickstarter is a popular choice for creative projects, as it allows creators to set up a page and receive funding from backers. However, Kickstarter is an all-or-nothing platform, meaning that if a project doesn't reach its funding goal, the creator doesn't receive any money.

Indiegogo is another popular crowdfunding platform that has a more flexible funding model, so creators can keep any money that they raise, even if they don't reach their goal.

There are also platforms specifically for charitable causes, such as GoFundMe and Razoo. When selecting a crowdfunding platform, it's important to consider your goals and what type of support you need from the platform.

f you're considering crowdfunding to raise money for your next project, you may be wondering whether to use Kickstarter or Indiegogo.

Both platforms are popular choices for crowdfunding, but they have different strengths and weaknesses.

Kickstarter is a great choice if you're looking to crowdfunding for a creative project, such as a new album or an art installation. The platform has a strong focus on creativity, and projects that are successfully funded often have a strong artistic element.

Indiegogo, on the other hand, is a good choice if you're crowdfunding for a practical project, such as a new product or a community initiative. The platform has a more diverse range of projects, and it's easier to find projects that align with your interests.

Ultimately, the best crowdfunding platform for you will depend on the type of project you're looking to fund.

Crowdfunding has become a popular way to raise money for small businesses and startup companies. Two of the most popular crowdfunding platforms are Wefunder and Republic.

Both platforms offer the same basic service: they allow businesses to post campaign pages and receive investments from a large pool of small investors. However, there are some key differences between the two platforms.

Wefunder is open to accredited and non-accredited investors, while Republic is only open to accredited investors.

Wefunder also offers a wider range of investment opportunities, including debt and revenue-sharing crowdfunding campaigns.

Republic, on the other hand, focuses exclusively on equity crowdfunding.

Which one you choose depends on your individual needs and investment goals. If you're looking for a wide range of investment opportunities, Wefunder is a good choice. If you're only interested in equity crowdfunding, Republic may be a better option.

Crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and investors.

Facebook offers crowdfunding opportunities for personal causes, like medical expenses or education costs, as well as charitable fundraising. For-profit businesses are not currently allowed to use Facebook crowdfunding.

If you're considering crowdfunding on Facebook, there are a few things to keep in mind. First, make sure your crowdfunding campaign complies with Facebook's Terms of Service.

You'll also need to create a crowdfunding page, which is different from a regular Facebook page. Be sure to populate your crowdfunding page with compelling content that will convince people to donate to your cause.

And finally, remember that crowdfunding is not an immediate solution - it can take time to build up momentum for your campaign. But if you're patient and put in the work, Facebook crowdfunding can be a great way to raise money for your cause.

Your crowdfunding campaign should make a good first impression. One of the best ways to do this is through your crowdfunding video.

Your crowdfunding video should be well-produced and engaging, and it should give potential donors a clear idea of what your project is all about. Here are a few tips to keep in mind when filming your crowdfunding video:

1. Make sure the video quality is high. Crowdfunding donors are more likely to take you seriously if your video looks professional.

2. Keep the video short and to the point. Potential donors will lose interest if your video is too long or rambling. Try to keep it under five minutes.

3. Be clear about what you're trying to raise money for. Donors need to know exactly how their money will be used.

4. Tell a compelling story. Why is your project worth crowdfunding? What difference will it make in the world? Aim to tug at potential donors' heartstrings and inspire them to give.

5. Ask for a specific amount of money. Don't just say that you're looking for "donations" - tell potential donors exactly how much you need to reach your goal.

By following these tips, you can create a crowdfunding video that will grab attention and get people excited about your project.

Luckily, there are a few things you can do to make sure your crowdfunding campaign is successful even after it ends.

First, be sure to thank all of your backers. A simple thank-you note or email can go a long way in showing your appreciation. You can also offer post-campaign rewards, such as t-shirts or mugs, to show your backers that they are appreciated.

Second, keep your backers updated on your progress. Let them know how you are using the funds you raised and what you have accomplished so far. This will help to build trust and keep your backers engaged.

Finally, don't forget to continue promoting your campaign. You can use social media, email marketing, and even traditional advertising to keep people interested in what you're doing. By following these tips, you can make sure your crowdfunding campaign is successful even after it ends.

When it comes to crowdfunding, there is no hard and fast rule for how much you can raise. It really depends on your crowdfunding campaign and what you are hoping to achieve.

If you have a strong crowdfunding platform and a clear fundraising goal, then you may be able to raise a significant amount of money.

However, if you are just starting out or your campaign is not very well organized, then you may only be able to raise a smaller amount.

In any case, it is important to remember that even a small amount of money can make a big difference in your crowdfunding campaign. So, don't be discouraged if you don't raise as much as you had hoped. Every little bit helps!

Crowdfunding is a unique way of funding a project or venture. Essentially, people donate money to your project in exchange for rewards.

However, if you don't reach your crowdfunding goal, you may not receive any money at all. This can be frustrating, especially if you've already spent time and money on your project.

There are a few things you can do if your crowdfunding campaign is unsuccessful. First, try reaching out to key donors and asking for additional funds.

Next, consider alternative sources of funding, such as loans or grants.

Finally, reevaluate your crowdfunding strategy and make sure you're offering compelling rewards that will entice people to donate.

By taking these steps, you can ensure that your project stays on track even if your initial crowdfunding campaign is unsuccessful.

Crowdfunding, the practice of funding a project or venture by raising small amounts of money from a large number of people, has become increasingly popular in recent years.

However, with so many crowdfunding platforms now available, it can be difficult to know which one to choose. Two of the most popular platforms are Kickstarter and Indiegogo. Both platforms offer a wide range of features and allow users to set up campaigns for a variety of projects.

There are some key differences between the two platforms. Kickstarter is more focused on creative projects, such as art, photography, and design. In contrast, Indiegogo allows users to crowdfund for a wider range of projects, including causes, start-ups, and personal expenses. In general,

Kickstarter is more restrictive in terms of who can create a campaign and what types of projects are allowed. However, Kickstarter does have a higher success rate in terms of funded projects. Ultimately, the best crowdfunding platform for you will depend on the type of project you are looking to fund.

Both Kickstarter and Gofundme have their own unique advantages and disadvantages.

Kickstarter is a crowdfunding platform that focuses on creative projects. Projects on Kickstarter must be able to offer rewards to backers, such as copies of the finished product or exclusive experiences related to the project.

In return for their support, backers receive these rewards once the project is completed. Kickstarter is an all-or-nothing platform, meaning that projects must reach their funding goal in order to receive any money. This can be a disadvantage if a project does not gain enough traction, but it also ensures that projects are properly funded before any money changes hands.

Gofundme, on the other hand, is a crowdfunding platform that focuses on personal causes and charitable giving. Projects on Gofundme do not need to offer rewards to backers and can instead rely on people's goodwill to support their cause.

Gofundme is a flexible funding platform, meaning that even if a project does not reach its funding goal, the creator will still receive any money that was pledged. This can be an advantage if a project is not able to gain enough momentum, but it also means that creators may not receive as much money as they originally hoped for.

Crowdfunding has become a popular way for artists and creators to raise money for their projects. However, there are a few different platforms to choose from, each with its own benefits and drawbacks.

Kickstarter is one of the most well-known crowdfunding platforms. It offers an all-or-nothing funding model, which means that creators only receive the money if they reach their goal. This can be helpful in motivating backers to pledge, but it also means that projects can come up short if they don't receive enough support.

Patreon, on the other hand, operates on a subscription-based model. This gives creators a steadier stream of income, but it can also be harder to attract backers. Ultimately, it's up to the creator to decide which platform is right for their project.

Kickstarter is a crowdfunding platform that focuses on creative projects. Projects on Kickstarter are typically things like new products, art or design projects, books, and films. One of the benefits of using Kickstarter is that it has a large community of users who are interested in supporting creative projects.

However, Kickstarter is also a closed platform, which means that only projects that are approved by Kickstarter can be posted on the site. This can be seen as positive or negative, depending on your point of view.

On the one hand, it means that there is some quality control; on the other hand, it means that you may have to wait longer to get your project approved. In addition, Kickstarter takes a percentage of all funds raised (5%), which may not be ideal if you're trying to raise a lot of money.

Crowdfunder, on the other hand, is an open crowdfunding platform that allows anyone to post a project. This makes it much easier to get started, but it also means that there is less quality control.

Crowdfunder does not take a percentage of funds raised; instead, they charge a flat fee for each project (ranging from $99 to $499). This makes Crowdfunder a better choice if you're looking to raise a large amount of money.

However, because Crowdfunder is less established than Kickstarter, it doesn't have as large or active a community. This can make it more difficult to get your project funded.

Both Kickstarter and Wefunder offer a way for people to solicit donations or investments from the general public. But what are the differences between these two platforms?

Kickstarter is a crowdfunding platform that focuses on creative projects. Anyone can create a project on Kickstarter, but projects must be approved by the Kickstarter staff before they can start soliciting funds.

Kickstarter is an all-or-nothing platform, which means that projects must meet their funding goals in order to receive any of the money that has been pledged.

This model incentivizes backers to pledge more money, as they know that their donation will only be collected if the project is fully funded.

Wefunder, on the other hand, is a crowdfunding platform for startups and small businesses. Startups can solicit investments from accredited investors on Wefunder, which means that they can raise much larger sums of money than would be possible on Kickstarter.

However, this also means that there are more regulatory hurdles to jump through in order to create a campaign on Wefunder.

Both Kickstarter and Wefunder are popular crowdfunding platforms with their own distinct advantages. Which one you choose will depend on your specific fundraising needs.

Kickstarter and Republic are two of the most popular crowdfunding platforms.

Kickstarter is a crowdfunding platform that specializes in creative projects, such as films, games, and books. It is one of the most well-known crowdfunding platforms and has a large community of backers.

However, Kickstarter charges a 5% fee on all funds raised.

Republic is a crowdfunding platform that specializes in startups. It has a lower fee than Kickstarter (3%), but it also has a smaller community of backers. As a result, it can be more difficult to reach your funding goal on Republic.

When choosing a crowdfunding platform, it is important to consider your project and your audience. If you are raising money for a creative project, Kickstarter is a good choice. If you are raising money for a startup, Republic may be a better choice.

In the past, crowdfunding was typically done through platforms like Kickstarter or GoFundMe, but in recent years, a new platform called StartEngine has emerged as a serious competitor in the space. So, here difference between these two platforms

Kickstarter has a more global reach than StartEngine, with projects funded on the platform coming from countries all over the world.

In addition, Kickstarter is more flexible when it comes to the types of projects that can be funded; while StartEngine is primarily focused on businesses and startups.

Kickstarter also allows for personal projects and charitable causes.

StartEngine does have some advantages over Kickstarter; for example, StartEngine allows campaign creators to offer equity in their venture in exchange for funding, whereas Kickstarter does not. Ultimately, which platform is better depends on the specific needs of the project creator.

Crowdfunding is the use of small amounts of money from a large number of people to finance a project or venture. Kickstarter and IndieGoGo are all popular crowdfunding platforms.

Each platform has its own rules and regulations, but in general, crowdfunding campaigns offer rewards or equity in exchange for pledges. Rewards-based crowdfunding is best suited for projects that can offer tangible rewards, such as products or experiences. Equity crowdfunding is best suited for projects that are looking to raise larger sums of money and can offer equity stakes in the company.

GoFundMe is a personal crowdfunding platform that is best suited for raising funds for personal causes. It’s typically used to raise money for medical expenses, education costs, or other personal needs. Unlike other crowdfunding platforms, GoFundMe does not require a monetary goal to be met in order for donors to give money.

Crowdfunding is typically used to finance new businesses or creative projects and can be a more attractive option than traditional forms of funding such as loans or investments from venture capitalists.

Equity crowdfunding on the other hand is a type of crowdfunding that allows investors to receive equity in the business in exchange for their investment. This can be an attractive option for businesses seeking to raise capital, as it allows them to retain control of the company.

However, it is important to note that equity crowdfunding is subject to regulation in many jurisdictions, and businesses should seek professional advice before launching an equity crowdfunding campaign.

Crowdfunding is the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet. Crowdfunding is a form of alternative finance, which has emerged outside of the traditional financial system.

Venture capital is a type of private equity, a form of financing that is provided by investors to small, early-stage, high-potential companies. Venture capital generally comes from well-off investors, investment banks, and other financial institutions.

So let's break down each, so you can make a better decision about which financing route to choose.

Crowdfunding is best for:

If you have a great idea but need help bringing it to life

If you need to raise money quickly

If you're not ready or don't want to give up equity in your company

If you want to test out your product before mass production

If you want to build a community around your product or service Venture capital is best for:

If you have a track record of success

If you're seeking a large amount of money

If you're willing to give up equity in your company

If you're looking for more than just funding (venture capitalists can also offer valuable mentorship and connections)

Crowdfunding is the practice of raising money for a project or venture by soliciting small contributions from a large number of people, typically via the Internet. Crowdfunding is usually used to finance creative or entrepreneurial projects, but it can also be used to fund a wide variety of other ventures, such as medical expenses, travel costs, or charitable causes. There are several crowdfunding platforms available online, each with its own set of rules and regulations.

Angel investing is the act of investing in a company at an early stage in its development in exchange for equity or convertible debt. Angel investors typically invest their own personal funds, as opposed to institutional investors, and they often provide mentorship and other forms of support to the companies they invest in. Angel investing can be a risky proposition, but it can also lead to high rewards if the company is successful.

Whether you should go with crowdfunding or angel investing depends on a number of factors, including the type of project or venture being funded, the amount of money needed, and the level of risk involved.

Crowdfunding may be a good option for projects that are creative or innovative in nature and that require relatively small amounts of funding. Angel investing may be a better option for more established companies that are looking for larger sums of money and that can offer potential investors a stake in the company.

Crowdfunding and crowdsourcing are two very different things.

Crowdfunding is the act of soliciting financial contributions from a large group of people, typically in return for some kind of reward. Crowdsourcing, on the other hand, is the practice of sourcing ideas or services from a large group of people, usually via the internet.

While crowdfunding can be used to finance a wide variety of projects, from movies to start-ups, crowdsourcing is typically used to generate ideas or solve problems. For example, a company might use crowdsourcing to solicit new product ideas from its customers or to find solutions to a problem that it has been unable to solve internally.

In general, crowdfunding is about raising money, while crowdsourcing is about raising ideas.

Crowdfunding is the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet.

Peer-to-peer crowdfunding (also known as P2P crowdfunding) is a type of crowdfunding that allows people to borrow and lend money directly to each other, without the need for a financial intermediary.

There are several key differences between crowdfunding and peer-to-peer crowdfunding.

First, with crowdfunding, the funds are typically provided by strangers, whereas with peer-to-peer crowdfunding, the funds are typically provided by friends, family, or other acquaintances.

Second, crowdfunding is typically used to finance projects or ventures, while peer-to-peer crowdfunding is typically used to finance personal loans.

Third, crowdfunding is often open to anyone who wants to contribute, while peer-to-peer lending is usually only available to members of a particular social network.

Fourth, crowdfunding platforms usually take a percentage of the funds raised, while peer-to-peer lending platforms typically don't charge any fees.

Finally, with crowdfunding, the amount of money that can be raised is limited only by the number of people who are willing to contribute, while with peer-to-peer lending, the amount of money that can be borrowed is limited by the size of the social network and the willingness of its members to lend.

This type of financing works well for inventors, start-ups and small businesses looking for an alternative way to find seed capital.

See More