Want a heads up when a new story drops? Subscribe here.

Financial institutions offer a host of critical services to corporate, business, and individual customers. Access to financing has become even more important in times of a pandemic crisis, with businesses operating in survival mode and households suffering financially. Financial services companies are not immune to economic shocks resulting from the global economic disruption that the pandemic caused. Banks are forced to operate in challenging and complex conditions, navigating muddy and unchartered waters most of the time.

While many finance providers have business continuity plans to maintain stability in recessionary times, pandemic planning is about achieving stability in the storm. This is because the impact of a prolonged and ongoing pandemic is difficult to assess. Pandemics are known to occur and unfold in multiple waves and across borders, threatening financial market stability.

It is a difficult time for financial institutions, many of which are struggling with low profitability as the global crisis shut down the world. As the crisis is already in full bloom, many banks are looking for ways to adapt their operating models and ensure they are well-positioned to exit the crisis. Facing low profitability, financial institutions will need to focus on customer expectations and needs to regain financial stability.

This involves improving customer service to communicate effectively about services and products that best meet individual financial needs. With social media user numbers skyrocketing in the past year, banks can no longer ignore social media and few do but many are struggling to position themselves or grow their social media presence. To help make a smooth and effective transition to social selling, here are some specific ways in which financial institutions can use social media and video production in 2022.

Table of Contents

1. Use Milestones

Buying a new home or vehicle is a major life event, and many would share about it on social media. The Sprout Social Index, Edition XIII: Moments & Milestones report shows that 44 percent of social media users would share about home move or purchase.

Other milestones that consumers share are educational, personal accomplishments, travel, and birth of a grandchild or child. Across all categories, consumers not only share but would also include a brand.

When purchasing or moving into a new home, 30 percent of users would also mention a brand. Financial institutions can capitalize on social media by commenting on or liking milestone posts when being tagged. A quick look at the 2020 Sprout Social Index, Edition XVI: Above & Beyond shows, however, that the banking and finance sector has an average response rate of just 28 percent.

Customers’ comments often remain unaddressed by major financial institutions on Social Media. Credits: The Official JPMorgan Chase&Co. Facebook page

In an industry where interaction is essential, engaging with consumers by commenting on milestone posts can win more customers. But there is more. Engaging with users helps banks gain a better understanding of their behaviour, emotions, interests, and preferences, and they can use this knowledge for customer profiling and targeting.

2. Social Media Content

Content variety is important in helping to diversify traffic, and more and more financial services companies are coming to realize this. With 66 million customers and growing social media following, Bank of America is a point in question. Instead of sharing content with audiences it might not resonate with, they post unique visuals specifically designed for different social networking sites. Bank of America currently has more than 1.6 million LinkedIn followers and over 2.77 million Facebook followers. Sharing unique visuals is certainly a powerful tool. Research by Buffer shows that Tweets that contain images get 150 percent more retweets.

Content comes in a great variety, from member and customer testimonials to profiling staff, sharing tips and tricks, and posting financial planning podcasts. Sharing the profiles of staff is a great way to humanize a brand by turning employees – every company’s biggest asset – into brand promoters.

Ponce Bank video created by SocialFix to celebrate company growth. Shared Ponce Banks’ Facebook page

Using customer testimonials helps establish trust as it is real people that explain the benefits of using specific products or services. Sharing content posted by local businesses also helps increase social media following. Tagging other businesses allows the fans of the particular entity to access the financial institution’s own content. Other ideas are to engage consumers by asking questions, posting service or product promotions, and sharing news on community service or outreach events showing how employees bond with community members.

3. Showcase Milestones

Showcasing milestones is a great way to acknowledge your company’s success. There are plenty of reasons to celebrate milestones, from showing consumers your proven track record and showcasing moments of accomplishment to celebrating relationships that go beyond business. It can be location, product, service area, or company anniversary milestones that highlight the important relationships that your business has with customers, partners, employees, and local communities.

Milestones that companies can share could be recent initiatives with charities and non-for-profits, employee achievements and promotions, and the company’s impact on local communities and industries.

4. Offer Educational Materials

According to data from the 2020 Edelman Trust Barometer, the financial services sector ranks last when it comes to consumer trust. The banking industry fares worse than sectors like entertainment, communications, healthcare, food and beverage, and automotive. It is not difficult to guess why consumers distrust financial institutions. The 2019 Survey of Consumer Finances reveals that the median household debt stood at $65,000 while the average household debt was at little over $140,000.

Having too much debt and paying it off along, whether credit cards or bills, can feel overwhelming. Consumers with a poor credit score not only miss on affordable loan products and premium credit cards but pay a lot in interest on mortgage, loan, and card products.

To deal with negative attitudes, especially among customers struggling with debt, financial services companies can provide educational materials that build trust among social media users. Financial literacy programs have already become an integral part of customer support, outreach, and financial marketing. Why not provide educational materials and helpful advice on social media? Reaching out to customers and helping them to solve financial problems helps reconnect and increases trust in the financial services sector.

5. Market to a Millennial Audience

Let’s face it, banking is not the most exciting of activities, especially for younger generations. Banks that are successful in addressing this challenge target a specific group – Generation Y or Millennials. Most Millennials are concerned they will be unable to meet major life goals like saving for retirement, paying off personal and student loans, and purchasing a home.

When it comes to money management, 24 percent of Millennials have student debt, and 60 percent report they would be unable to cover a $1,000 emergency expense. They would have to get a loan, use their credit card, or borrow from friends or family to cover it.

It is not surprising that Millennials distrust and are highly skeptical of big banks. A report by George Washington University and the Global Financial Literacy Excellence Centre shows that just 27 percent of Millennials turn to a professional financial advisor for matters related to investment and saving.

And while millennials show disdain for financial institutions, many of them have already reached their prime spending and working years and are about to make important financial decisions. They need someone to turn to for guidance and advice, which is an excellent opportunity for banks that want to increase their reach. Banks will need to increase their social media presence to target younger customers and establish a brand voice to successfully market to a millennial audience that is significantly impacted by social media. A recent report on 2020 consumer culture shows that 77 percent of Millennials use Facebook daily compared to 68 percent of Generation X users.

6. Customer Service

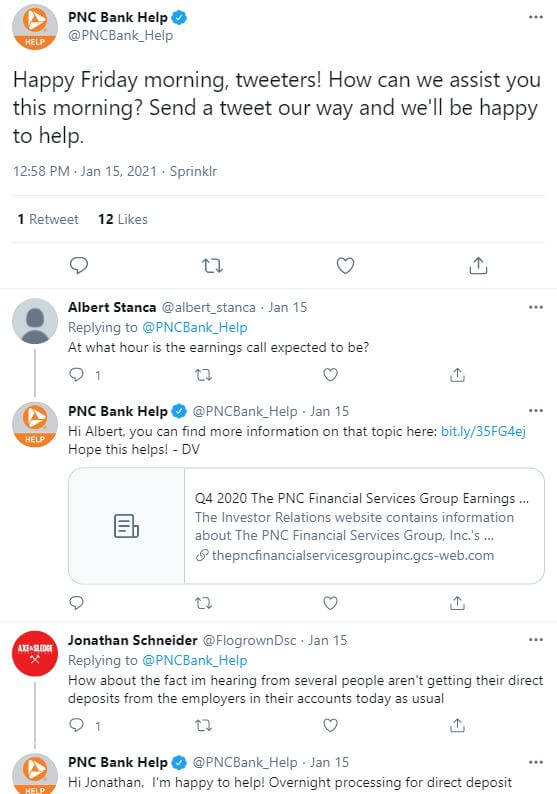

Offering help and solving customer support issues on social media is a great way for banks to shine. And this is exactly what PNC Bank does. The bank has a Twitter account to help users with customer service problems.

Their Twitter customer care team offers help with issues like reporting lost or stolen credit cards, linking accounts to financial apps, etc. In addition to offering help to customers, PNC Bank regularly features contests and giveaways to increase social media engagement. Currently the bank has nearly 34K Twitter followers and 333K Facebook followers, clearly showing that their creative, personalized approach to customer service has been successful in building trust.

PNC Bank has created a dedicated Twitter handle for Customer Support Issues.

7. Run Contests

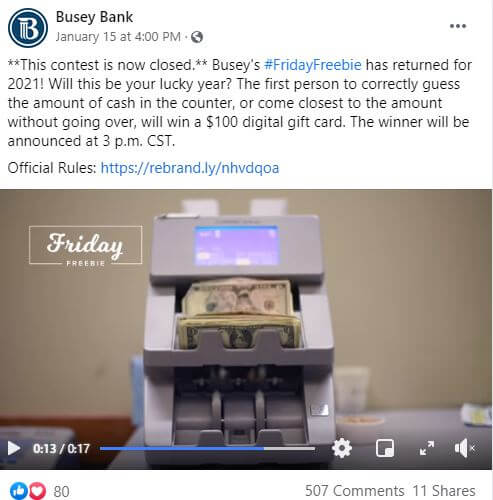

We all love free stuff, and that is why contests and giveaways are so popular on social media. Financial institutions like Busey Bank and First National Bank have ramped up their social media audiences by running contests and engaging customers in community-oriented activities.

Busey Bank Facebook Contest: “Guess the right amount”

One of Busey Bank’s Hometown Heroes contest, for example, asked social media users to share a story about a hometown hero who has made an important contribution to community wellbeing.

Contests can help financial institutions to build a solid community presence, increase customer loyalty, enhance brand awareness, and ultimately increase sales. Contests also help increase customer engagement as they bring followers who pin, like, retweet, and share posts.

When businesses create contests asking followers to share videos, photos, or interesting stories, they increase their chances of getting their brand noticed by others. Offering engaging ways to participate and share with others is a form of word to mouth advertising that can help increase subscribers and drive use of financial products.

8. Organize a Webinar

Marketing an upcoming seminar can help generate conversations and engagement, and there is a good reason why. First of all, webinars are unique one-time events that happen in real time. If attendees fail to show up or are late, they are going to miss all or part of what the webinar is about. This creates a sense of urgency that makes people act. An increasing number of businesses use scarcity marketing as the foundation of their social media campaigns. Scarcity marketing is about creating a sense of shortage to increase engagement and ultimately sell more. This is because scarcity drives up the perceived value of a service or product that businesses offer.

Another reason for organizing a webinar is to drive conversational engagement. Attendees can answer questions, share opinions, discuss strategies, ask questions, or simply chat. When involved in two-way communication, people are more likely to be engaged and focused, with brand messaging resonating with them.

9. Integrate Video Content

There are plenty of creative ways to integrate video content into your financial institution’s marketing strategy. From financial education and service and product demos to storytelling and branding, video content helps showcase brand identity, increase user engagement, and enhance online visibility. Businesses are increasingly investing in video projects because they are shown to drive a significant increase in organic search engine traffic.

According to the Cisco Visual Networking Index: Forecast and Methodology, 2016–2021 in 2021, video accounted for 82 percent of all internet traffic. One reason for its huge success is that video content conveys cues like eye contact, tone of voice, and body language that help trigger emotional response.

Emotions have a major role to play in information retention. A 2007 study by the Advertising Research Foundation and American Association of Advertising Agencies develops this line of thought by highlighting the fact that decisions are first driven by emotions and then rationalized by logic. Content that generates strong emotional response fares better on indicators such as liking, persuasion, and recall than advertisements that don’t generate a response. Emotional response not only precedes rationalizing but facilitates retention and influences actions.

There are many examples of emotional content that can help drive sales volumes – videos that feature surprising twists, stories about real people, issues, and concerns, and stories about belonging and connectedness, to name a few.

Video content comes in different formats depending on the message that businesses are trying to communicate. From animations, videos, and brand films to company culture videos, tutorials, and video documentaries, there are plenty of ways to grab attention and teach online audiences something new and valuable.

10. Advertise Service and Product Promotions

Social media can be an important channel for consumer engagement, brand awareness, customer support, and lead generation. According to The State of Social 2016 report, the main reasons why companies use social media include content distribution (61 percent), community engagement (71 percent), brand awareness (85 percent), and sales generation (54 percent). Service and product promotions not only create a communication opportunity but help increase sales volumes when done right. According to experts, it is best to follow the 80/20 rule, where 20 percent should be promotional content of some kind and 80 percent should be useful, educational, and engaging.

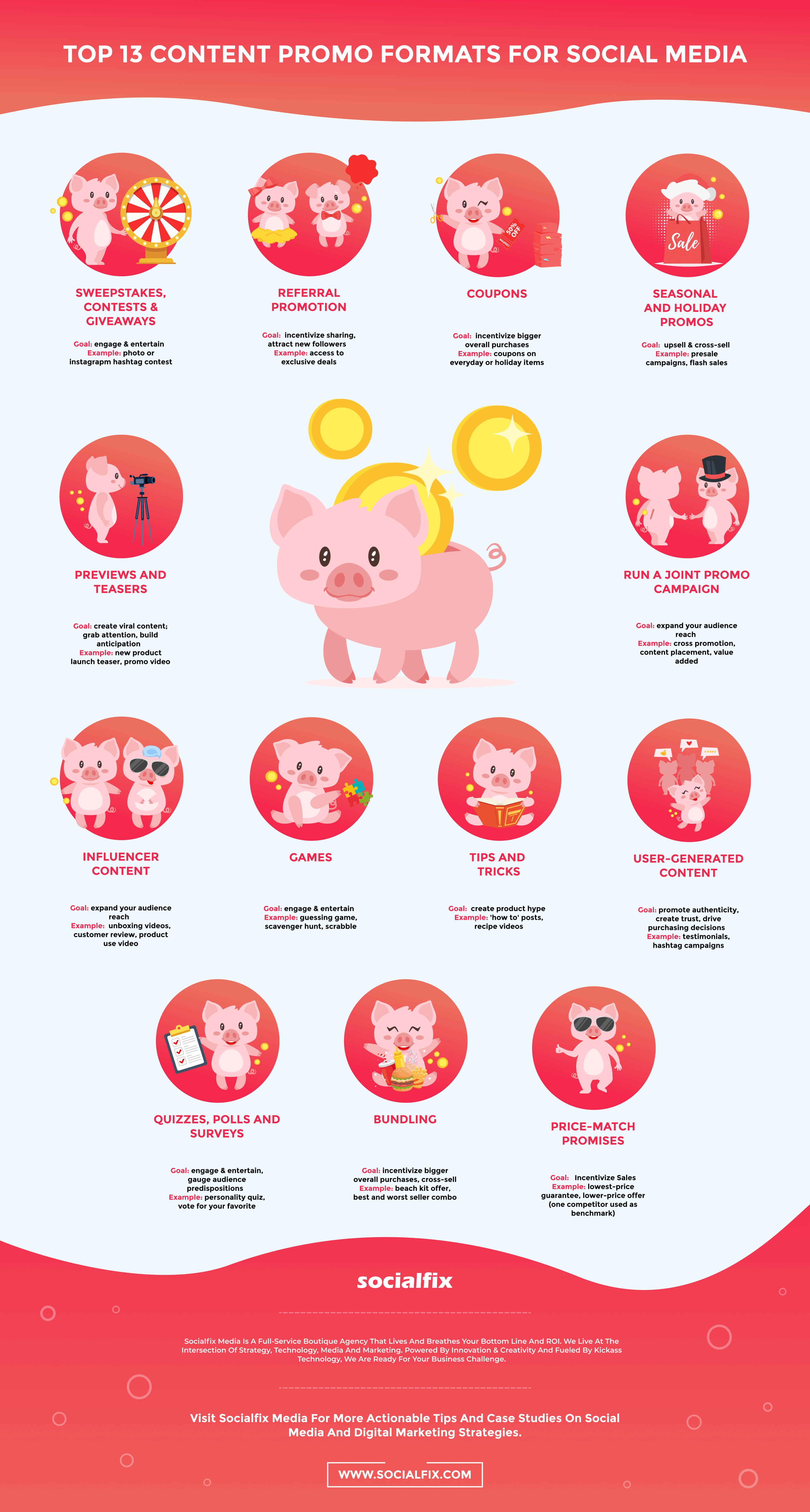

When it comes to format, sales promotions can be in the form of:

- Sweepstakes

- Product demonstrations

- Price-match promises

- Loyalty programs and points

- Flash sales

- Games and contests

- Bundling

- Loss leaders

Other examples include rebates, prizes, premiums, point of purchase displays, freebies, and coupons. Rewards points and money back are incentives that most banks use, but as you can see, there are plenty of ways to incentivize. Different strategies can be used to motivate consumers to buy products or services, the main ones being adding value and lowering the purchase price. Ultimately, the goal is to stimulate trial or interest, whether featuring scratch and win, money back, or bonus offers.

For financial institutions sales promotions present an opportunity to offer a new product or service or cross-sell or upsell products. This is also an opportunity to cast products as unique and make them stand out in a crowd so that customers steer business their way.

Like other businesses, financial institutions need to attract and aware customers to be able to sell their offerings. Marketing departments increasingly use a promotional mix which includes direct marketing, public relations, direct selling, and sales promotions. Product promotions, in particular, aim to convey benefits, sell particular service or product, or encourage greater or quicker purchase. The ultimate goal is to accelerate sales either in quantity or time.

Final Words

Businesses need many things to increase their market presence, from top-of-the-line services and products and compelling offerings to visionary leadership. In today’s crowded marketing space, however, businesses need to have a human face and a story. Banks and financial institutions are no exception in that customers want them to develop a human face. One of the biggest fears that consumers have is that instead of being a global community, social media will eventually turn into a huge marketplace. Putting the human element back into a company brand helps alleviate fears by forming a human connection with customers. By organizing webinars, offering helpful advice, or showcasing milestones, financial institutions help customers to connect and identify with their organization. While companies don’t really have a face, their staff does. By showing the diverse, real faces that make companies what they are, businesses are able to create a more personal connection and strong and long-lasting consumer-brand relationships.